Who can resist a good bargain? We’re only human after all! But sometimes, when it comes to buying life insurance, the cheapest option isn’t alwaysthe best option. We’re going to talk you through some of the reasons why it could make sense to avoid underinsurance, and more importantly, how to make sure your policy provides adequate cover.

Insurance: a sense of security

Many people take out insurance to gain a sense of increased financial security. Whether it’s our car, our home or our pets, we want to know that if something goes wrong, we have a financial safeguard in place. If this is the case, then why pay for something that doesn’t make you feel confident you’re protected?

The fact that we rely on insurance for financial protection means that being underinsured can have serious implications, no matter what kind of insurance you’re buying. You wouldn’t buy cheaper car insurance if it only insured the front half of your car, would you? Well, maybe you would but the point is, you could be left vulnerable as a result of this.

With the right amount of insurance, you can rest easy knowing you and your family have some financial protection in place. The ideal policy is one that’s affordable and provides sufficient cover for you and your loved ones.

What is underinsurance?

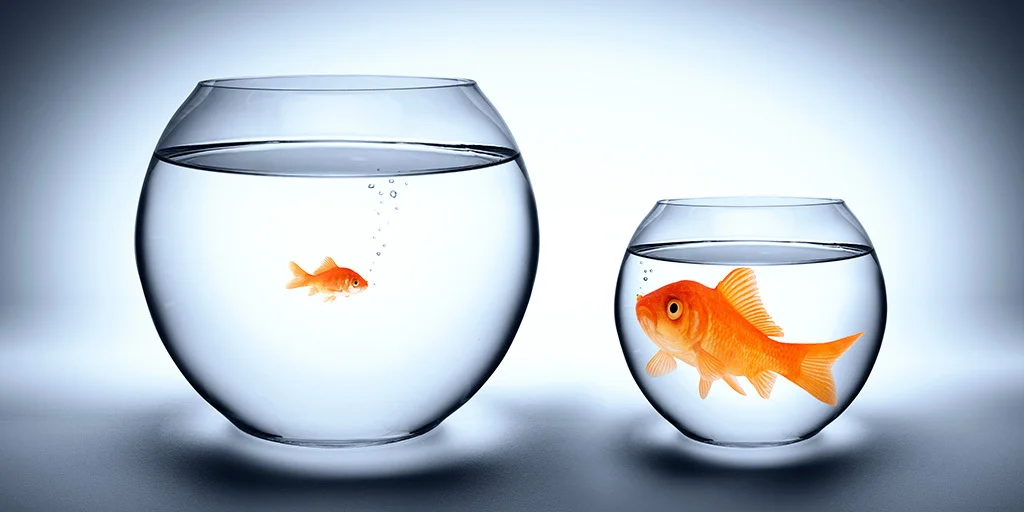

When it comes to life insurance, being underinsured means that the insurance you’re paying for doesn’t provide enough of a financial cushion to adequately help protect your family.

For example, if the benefit amount is too little to pay off your mortgage in the event of your death, your family could be at risk as a result of underinsurance. Or, the term you’ve chosen is too short to match the length of time it takes to pay off your mortgage, you may be underinsured.

What are the implications of underinsurance?

Taking on the cheapest policy you can find might seem like a good idea at the time - especially if you’re on a tight budget - but the fact is, it could have financial implications for your family down the line.

When it comes down to it, there’s no point in paying a lot of money into a policy that fails to meet your families needs. In some cases, a few pounds extra each month can be the difference between adequate and inadequate insurance.

How to avoid underinsurance

Grab your calculator because this will require some maths. When you’re buying insurance, don’t just pluck a number out of thin air. Calculate what you need from your policy’s benefit amount - or more so, what your family will need if you can no longer support them.

Using life insurance to help financially protect your family will take careful consideration when working out a sufficient benefit amount. Begin by deciding what you would like the benefit amount to cover. Some common things that people use their life insurance benefit for include:

- Funeral Costs

- Mortgage Payments

- Utility Bills

- Living Costs

- University Tuition

- Family Holidays

Work out how long you will need to cover such expenses and how much they will cost over time.

Then, consider your other monthly expenses and outgoings and get to work. You can always use our guide to Calculating Your Life Insurance Policy to ensure that you’ve taken out enough insurance. This process can also prevent you from taking out too much insurance and paying more than you can realistically afford.

To help you wrap your head around all of this, let’s look at some common scenarios where someone might need adequate life insurance...

Mortgages

People often use life insurance to help protect their family from outstanding mortgage payments. Could your family afford to keep a roof over their heads if you were to die or become seriously ill or injured? Could your spouse keep up with mortgage payments without the contribution of your paycheck? A life insurance payout could help them manage these expenses.

A term policy like our Family Life Level Policy is a popular choice with those who want to help protect their loved ones for a fixed term. When taking out a term policy, you will decide how long you want the cover to last for example 20 years, 30 years, 40 years.

Assuming you keep on top of your monthly premiums, you’re protected within that fixed term and your family will receive a lump-sum payment should you die.

Protecting your family

If you have a family, you can put protection in place so that they can keep up with rent, utilities and living costs when you die. Maybe you would like to leave enough behind so that your family can continue to manage these things once the grief has settled. Why should your family have to sacrifice the little joys in life while already coping with the loss of a parent?

If you wish to protect your family until your children are old enough to fly the coop, then you could consider a term policy. If you would like to take out a policy that lasts for your entire life and pays out a larger sum to your family, you can choose a whole life policy like our Family Life Age-Based Policy.

The premiums you pay on our Age-Based policy gradually increase over the years to coincide with your age. This feature makes it a great option if you’re on a tighter budget during the earlier years of your policy. You see, you don’t have to sacrifice having enough protection to find a reasonable rate. We offer lots of options and flexible life insurance solutions.

Taking your protection up a notch

If you still feel like you want more coverage, bear in mind that Smart offers optional extra cover.

Children’s Cover can help with extra costs that are incurred from things like medical expenses or school tuition fees if your child suffers one of the defined serious injuries or illnesses which result in permanent irreversible symptoms. The benefit amount is also paid in the event of an Accidental Death.

Critical Illness Cover pays a benefit amount to you if you suffer a defined serious illness. This includes; cancer (excluding less advanced cases), coronary artery bypass grafts (with surgery to divide the breastbone), heart attack (of specified severity), or stroke (resulting in permanent symptoms).

Getting it right

We know that money doesn’t grow on trees and we’re certainly not saying you should bite off more than you can chew. What’s important here is getting your benefit amount right so that it fits into your budget and provides the right level of coverfor you and your family.

You can always compare different policies and figure out which one suits your needs best. If you decide you want to take the next step to help protect your family, you can apply for your free quote online today.